Embark on a journey through the realm of Debt Financing Options for Small and Medium Enterprises, where we explore the myriad ways businesses can secure funding to thrive and succeed.

Delving into the nuances of various debt financing options, this guide sheds light on the intricacies of financial support for enterprises looking to grow and expand.

Types of Debt Financing Options

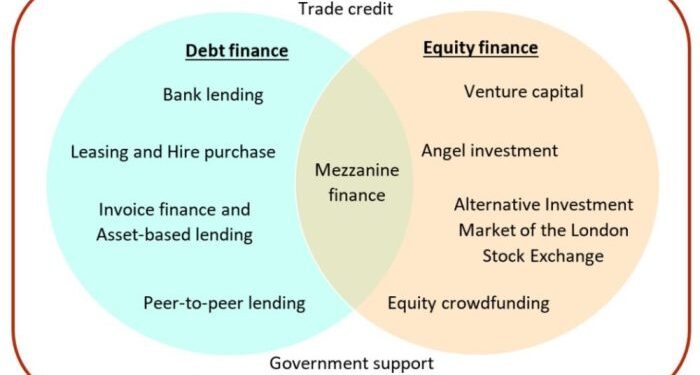

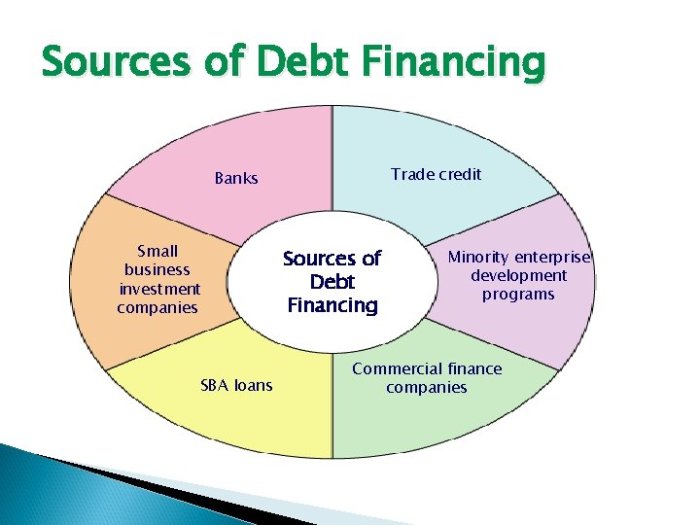

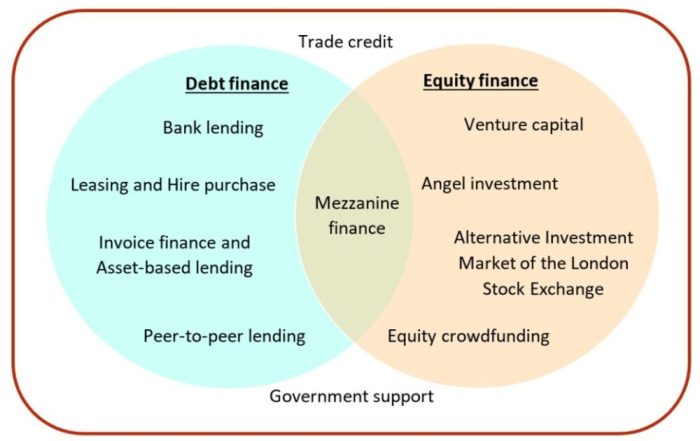

Debt financing is a common way for small and medium enterprises to raise capital for their business operations. There are various types of debt financing options available to these businesses, each with its own characteristics and benefits.

Term Loans

Term loans are a popular form of debt financing where a business borrows a specific amount of money from a financial institution and agrees to repay it over a set period of time with interest. This type of financing is ideal for businesses looking to fund long-term projects or investments.

Examples of successful businesses that have utilized term loans include tech startups expanding their operations and manufacturing companies investing in new equipment.

Lines of Credit

Lines of credit provide businesses with access to a predetermined amount of funds that they can draw from as needed. This type of debt financing offers flexibility as businesses only pay interest on the amount they use. It is commonly used for managing cash flow fluctuations and covering short-term expenses.

Businesses in the retail industry often use lines of credit to purchase inventory during peak seasons.

Asset-Based Loans

Asset-based loans are secured by the assets of the business, such as inventory, equipment, or accounts receivable. These loans are ideal for businesses that may not qualify for traditional loans but have valuable assets to leverage. Successful businesses that have utilized asset-based loans include construction companies needing to purchase new equipment and service-based businesses with valuable accounts receivable.

Commercial Real Estate Loans

Commercial real estate loans are used by businesses to purchase, refinance, or renovate commercial properties. These loans are secured by the property itself and are typically long-term with competitive interest rates. Businesses in the hospitality industry looking to expand their property portfolio and retail businesses looking to purchase their own storefronts often utilize commercial real estate loans.

Pros and Cons of Debt Financing

Debt financing can be a valuable tool for small and medium enterprises looking to grow and expand their operations. However, it also comes with its own set of advantages and disadvantages that business owners need to carefully consider before deciding to take on debt.

Advantages of Debt Financing

- Access to Capital: Debt financing provides immediate access to capital that can be used to fund business growth, purchase inventory, or invest in new equipment.

- Tax Benefits: The interest paid on business loans is often tax-deductible, reducing the overall tax liability of the company.

- Ownership Retention: Unlike equity financing, debt financing does not require business owners to give up a portion of their ownership stake in the company.

- Fixed Repayment Terms: Debt financing typically comes with fixed repayment terms, making it easier for businesses to budget and plan for future expenses.

Disadvantages of Debt Financing

- Interest Payments: Taking on debt means incurring interest payments, which can add up over time and increase the overall cost of the loan.

- Risk of Default: If a business is unable to make its debt payments, it may face the risk of default, which can have serious consequences such as damage to credit score or even bankruptcy.

- Financial Strain: High levels of debt can put a strain on a company's finances, limiting its ability to invest in other areas of the business or weather economic downturns.

- Limited Flexibility: Debt financing often comes with strict repayment terms and conditions that can limit a company's flexibility in managing its finances.

Factors to Consider When Choosing Debt Financing

When small and medium enterprises are looking to choose a debt financing option, there are several key factors they should take into consideration to make an informed decision

Interest Rates

Interest rates play a crucial role in determining the overall cost of borrowing. It is essential to compare the interest rates offered by different lenders and choose the option that offers the most competitive rates. Lower interest rates can help reduce the financial burden on the business in the long run.

Repayment Terms

Understanding the repayment terms is vital as it determines the amount and frequency of payments that need to be made. Some debt financing options may offer flexible repayment schedules, while others may have more rigid terms. It is important to assess the business's cash flow and choose a repayment plan that aligns with its financial capabilities.

Collateral Requirements

Many lenders require collateral to secure the debt financing, especially for larger loan amounts. It is crucial to evaluate the collateral requirements of different financing options and assess whether the business has assets that can be used as collateral. Understanding the collateral requirements can help mitigate risks associated with defaulting on the loan.

Assessing Financial Health

Before taking on debt, it is essential for small and medium enterprises to assess their financial health. This includes reviewing financial statements, cash flow projections, and overall business performance. By understanding the business's financial standing, it becomes easier to determine the amount of debt that can be comfortably taken on and repaid without straining the business's resources.

Application Process for Debt Financing

When applying for debt financing as a small or medium enterprise, there are several steps involved to increase your chances of securing the funding you need.

Documentation and Financial Information Required

- Prepare a detailed business plan outlining your company's objectives, financial projections, and how the loan will be used.

- Gather financial statements, including balance sheets, income statements, and cash flow statements, to demonstrate your company's financial health.

- Provide personal and business tax returns, as well as any other relevant financial documentation requested by the lender.

- Include information on any collateral you can offer to secure the loan, such as property, inventory, or equipment.

Tips for a Compelling Business Case

- Highlight your company's unique selling points and competitive advantage to showcase why it is a worthwhile investment for the lender.

- Demonstrate a clear repayment plan, including how the loan will be repaid and the impact it will have on your company's cash flow.

- Emphasize your management team's experience and qualifications to instill confidence in the lender about your ability to successfully manage the funds.

- Be prepared to explain any potential risks associated with the loan and how you plan to mitigate them to reassure the lender of a successful partnership.

Conclusion

In conclusion, navigating the landscape of debt financing options can be a strategic move for small and medium enterprises aiming for sustainable growth and prosperity.

FAQs

What factors should SMEs consider when choosing debt financing?

SMEs should assess interest rates, repayment terms, and collateral requirements to make informed decisions. It's also crucial to evaluate the business's financial health before taking on debt.

How can businesses prepare a compelling case for securing debt financing?

Businesses can enhance their chances by providing thorough documentation, showcasing a clear repayment plan, and demonstrating a strong business strategy.