Exploring the world of US Tech 100 TradingView Insights for Market Analysis, this introduction sets the stage for an informative and engaging discussion. Dive into the realm of market analysis with a focus on technology stocks, as we uncover the tools and data at your disposal for making informed trading decisions.

As we delve deeper into the significance of TradingView and its impact on market analysis, you'll gain valuable insights into the key indicators, strategies, and metrics that can shape your trading journey.

Overview of US Tech 100 TradingView Insights

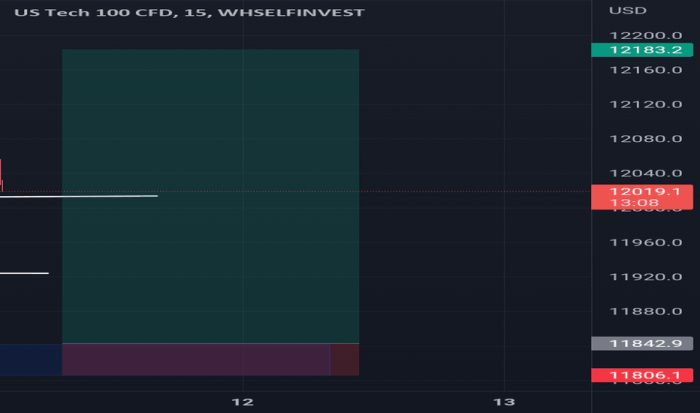

US Tech 100 TradingView Insights provide valuable information and analysis on the Nasdaq 100 index, which includes the top technology companies in the US stock market.

TradingView is a popular platform for traders and investors to conduct technical analysis, access real-time market data, and collaborate with other users. It offers a wide range of tools and features to analyze market trends and make informed trading decisions.

Types of Information Available

- Real-time price quotes and charts for the Nasdaq 100 index.

- Technical indicators and drawing tools to analyze price movements and identify potential entry or exit points.

- Market sentiment data, including trader positioning and sentiment analysis, to gauge market sentiment and potential market direction.

- Customizable watchlists and alerts to track specific stocks or indices and receive notifications based on predefined criteria.

- Community insights and trading ideas shared by other users, providing additional perspectives and strategies for trading the US Tech 100.

Importance of Market Analysis in Trading

Market analysis plays a crucial role in the decision-making process of traders across various financial markets. By examining and interpreting market data, traders can gain valuable insights into the current trends, potential opportunities, and risks involved in trading.

Impact of Market Analysis on Trading Decisions

Market analysis directly influences trading decisions in several ways:

- Identifying Trends: Through market analysis, traders can identify trends in the price movements of assets, which helps in making informed decisions on whether to buy or sell.

- Risk Management: By analyzing market data, traders can assess the potential risks associated with a particular trade and implement risk management strategies accordingly.

- Entry and Exit Points: Market analysis helps traders determine optimal entry and exit points for their trades based on key support and resistance levels, trend lines, and other technical indicators.

Contribution of US Tech 100 TradingView Insights

US Tech 100 TradingView Insights provide traders with valuable information and analysis specific to the Nasdaq 100 index, which comprises top technology companies like Apple, Microsoft, and Amazon. These insights offer a deep dive into market trends, price movements, and key levels, enabling traders to make well-informed decisions when trading the US Tech 100.

By leveraging these insights, traders can stay ahead of market developments and capitalize on profitable opportunities within the tech sector.

Key Indicators and Metrics in US Tech 100 TradingView Insights

When analyzing the US Tech market, it is crucial to consider key indicators and metrics provided in US Tech 100 TradingView Insights. These indicators offer valuable insights into the performance and trends of tech stocks, helping traders make informed decisions.

Main Indicators in US Tech 100 TradingView Insights

- Relative Strength Index (RSI): This indicator measures the speed and change of price movements, indicating whether a stock is overbought or oversold.

- Moving Averages: These indicators smooth out price data to identify trends over time, such as the 50-day and 200-day moving averages.

- Volume: This metric shows the number of shares traded, providing insight into the level of market participation and interest in a particular stock.

How Indicators Help in Analyzing the US Tech Market

The indicators in US Tech 100 TradingView Insights help traders assess the strength of trends, identify potential reversal points, and confirm the overall market sentiment. By analyzing these indicators collectively, traders can gain a comprehensive view of the market dynamics and make well-informed trading decisions.

Comparison with Other Platforms

US Tech 100 TradingView provides a wide range of indicators and metrics that are essential for technical analysis. When compared to other platforms, TradingView stands out for its user-friendly interface, customizable charting tools, and extensive library of technical indicators. Traders can easily access and apply these indicators to conduct thorough market analysis and enhance their trading strategies.

Strategies for Utilizing US Tech 100 TradingView Insights

When it comes to incorporating US Tech 100 TradingView Insights in trading, there are several effective strategies that traders can use to make informed decisions and maximize the benefits of these insights.

Implementing Technical Analysis

- Utilize key technical indicators such as moving averages, Bollinger Bands, and Relative Strength Index (RSI) to identify trends and potential entry/exit points.

- Combine technical analysis with chart patterns like head and shoulders, double tops/bottoms, and triangles to confirm signals and make more accurate predictions.

- Set up alerts for specific price levels or technical signals to stay informed and act promptly on trading opportunities.

- Regularly review historical price data and patterns to gain insights into potential future price movements.

Following Market Sentiment

- Monitor news, social media, and analyst reports for updates on market sentiment towards US Tech 100 stocks.

- Pay attention to any significant events or developments that could impact the tech sector and adjust your trading strategy accordingly.

- Consider the overall market sentiment and investor behavior to gauge the direction of the US Tech 100 index and individual stocks.

Risk Management and Position Sizing

- Set clear stop-loss levels based on your risk tolerance and the volatility of US Tech 100 stocks to protect your capital.

- Diversify your portfolio and avoid overleveraging by carefully sizing your positions in accordance with your trading plan.

- Regularly assess and adjust your risk management strategy based on the changing market conditions and your trading performance.

Outcome Summary

In conclusion, US Tech 100 TradingView Insights offer a wealth of information for traders looking to navigate the tech market with confidence. By leveraging these insights effectively, you can stay ahead of the curve and make strategic decisions that align with your trading goals.

Expert Answers

What are US Tech 100 TradingView Insights?

US Tech 100 TradingView Insights provide valuable information and data on technology stocks, helping traders analyze market trends and make informed decisions.

Why is market analysis crucial for traders?

Market analysis is essential for traders to understand market trends, identify potential opportunities, and manage risks effectively.

How can traders maximize the benefits of using US Tech 100 TradingView for market analysis?

Traders can maximize benefits by utilizing the key indicators, metrics, and strategies provided by US Tech 100 TradingView Insights to make informed trading decisions.