JNJ Stock Overview: What Long-Term Investors Should Know sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we delve deeper into the world of Johnson & Johnson, we uncover a tapestry of history, financial prowess, and future potential that beckons the prudent investor to take notice.

JNJ Company Overview

Johnson & Johnson, founded in 1886, is a multinational company that focuses on healthcare products. The company has a long history of providing pharmaceuticals, medical devices, and consumer health products to customers worldwide.

Key Products and Services

- Pharmaceuticals: JNJ offers a wide range of prescription drugs, including treatments for oncology, immunology, and cardiovascular diseases.

- Medical Devices: The company produces surgical equipment, orthopedic devices, and diagnostic tools used in healthcare settings.

- Consumer Health: Johnson & Johnson is known for its popular consumer brands like Band-Aid, Neutrogena, and Tylenol, offering a variety of over-the-counter products for personal care and wellness.

Company Mission and Values

- Johnson & Johnson's mission is to improve the health and well-being of people around the world.

- The company values integrity, diversity, and innovation in delivering high-quality healthcare solutions.

- JNJ is committed to ethical business practices and sustainability initiatives to make a positive impact on society and the environment.

JNJ Financial Performance

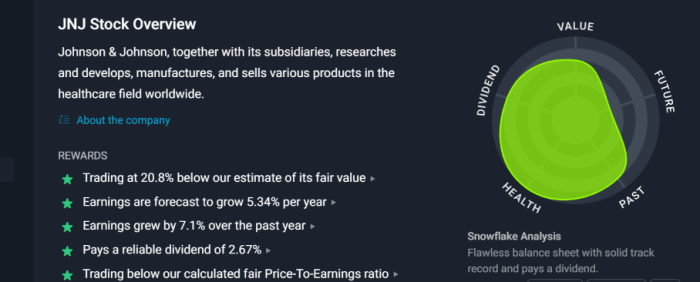

Investors looking at Johnson & Johnson (JNJ) for the long-term should consider the company's financial performance. Let's analyze how JNJ has fared historically and compare its financial ratios with industry peers.

Historical Stock Performance

Johnson & Johnson (JNJ) has a strong track record of delivering solid returns to investors over the years. The stock has shown resilience even during market downturns, making it a popular choice among long-term investors. Despite facing challenges like legal issues and competition, JNJ's stock has managed to maintain a stable growth trajectory.

Comparison with Industry Peers

When comparing JNJ's financial ratios with its industry peers, it is evident that the company stands out in terms of stability and profitability. JNJ has consistently exhibited strong financial health, with healthy margins and efficient use of assets. This has helped the company maintain a competitive edge in the healthcare sector, outperforming many of its rivals.

Recent Financial News and Events

In recent times, Johnson & Johnson (JNJ) has been in the spotlight due to various financial news and events. From settlements related to lawsuits to the impact of the COVID-19 pandemic on its business, JNJ has faced both challenges and opportunities.

It is crucial for investors to stay informed about these developments as they can have a significant impact on JNJ's stock performance in the long run.

Long-Term Investment Potential

Investing in Johnson & Johnson (JNJ) for the long term can be appealing to many investors due to various factors contributing to its growth prospects and stability. However, like any investment, there are risks that could affect JNJ's stock in the long run.

Factors Contributing to JNJ’s Long-Term Growth Prospects

- Strong Pharmaceutical Segment: JNJ's pharmaceutical division has a robust pipeline of innovative drugs and a history of successful product launches, positioning it well for future growth.

- Diversified Healthcare Portfolio: With business segments in pharmaceuticals, medical devices, and consumer health products, JNJ has a diversified portfolio that can withstand market fluctuations.

- Global Presence: JNJ has a global footprint, allowing it to capitalize on emerging markets and demographic trends, such as an aging population in developed countries.

- Ongoing Research and Development: JNJ's commitment to research and development ensures a steady stream of new products and innovations, driving long-term growth.

Key Risks Affecting JNJ’s Stock in the Long Run

- Regulatory Challenges: Given the highly regulated nature of the healthcare industry, changes in regulations or unexpected legal issues could impact JNJ's operations and profitability.

- Competition: Intense competition in the healthcare sector could affect JNJ's market share and pricing power, leading to potential revenue declines.

- Product Recalls: Any product recalls or quality control issues could damage JNJ's reputation and erode consumer trust, impacting long-term sales.

JNJ’s Dividend History and Attractiveness for Long-Term Investors

- JNJ has a long history of paying dividends, with a track record of consistent and reliable dividend payments to shareholders.

- The company's strong cash flow and stable earnings provide a solid foundation for sustaining and potentially increasing dividends over the long term.

- For long-term investors seeking income and stability, JNJ's dividend yield and history make it an attractive investment option.

Industry Position and Competitors

Johnson & Johnson (JNJ) holds a prominent position within the healthcare industry, known for its diversified portfolio of pharmaceuticals, medical devices, and consumer health products. With a strong global presence and a history of innovation, JNJ has solidified its reputation as a leader in the healthcare sector.

Comparison with Competitors

- JNJ faces competition from other major players in the industry such as Pfizer, Merck, and Novartis.

- In terms of market share, JNJ ranks among the top pharmaceutical companies globally, competing closely with its main rivals.

- When it comes to innovation, JNJ has a track record of developing breakthrough drugs and medical technologies, setting itself apart from competitors.

Recent Industry Trends

- One significant trend impacting the industry is the rise of personalized medicine and targeted therapies, which could present both challenges and opportunities for JNJ.

- The increasing focus on digital health solutions and telemedicine services is also reshaping the healthcare landscape, potentially influencing JNJ's long-term growth strategies.

- Regulatory changes, healthcare reforms, and the evolving landscape of healthcare delivery are additional factors that could affect JNJ's performance in the industry.

Outcome Summary

In conclusion, JNJ Stock Overview: What Long-Term Investors Should Know encapsulates the essence of a company that has stood the test of time, offering insights and opportunities for those seeking to navigate the complex landscape of long-term investments.

Frequently Asked Questions

What is Johnson & Johnson's dividend history like?

Johnson & Johnson has a consistent track record of paying dividends to its shareholders, making it an attractive option for long-term investors seeking stable returns.

How does JNJ's financial performance compare to its industry peers?

Johnson & Johnson's financial performance often outshines its competitors, showcasing strong fundamentals and resilience in volatile market conditions.

What are the key risks that could impact JNJ's stock in the long run?

Factors such as regulatory changes, litigation issues, and healthcare market dynamics pose potential risks to JNJ's stock in the long term.