Delve into the world of financial advisors with a focus on Fiduciary Financial Advisor vs Traditional Advisor Explained. Brace yourself for a journey filled with insights and comparisons that will shed light on these two distinct roles in the financial planning realm.

Explore the nuances and intricacies of fiduciary and traditional advisors to gain a comprehensive understanding of how each approaches financial guidance and client relationships.

Fiduciary Financial Advisor vs Traditional Advisor Explained

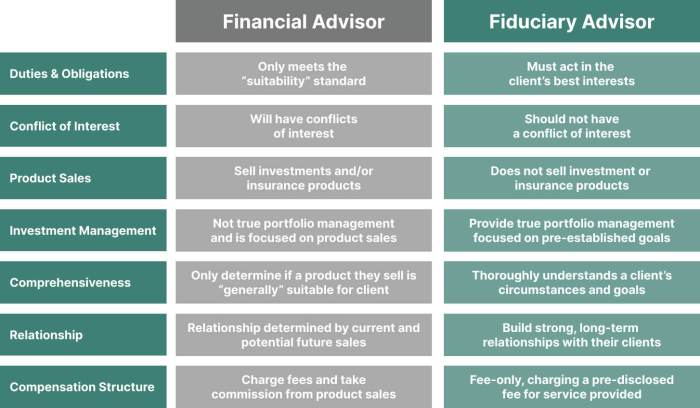

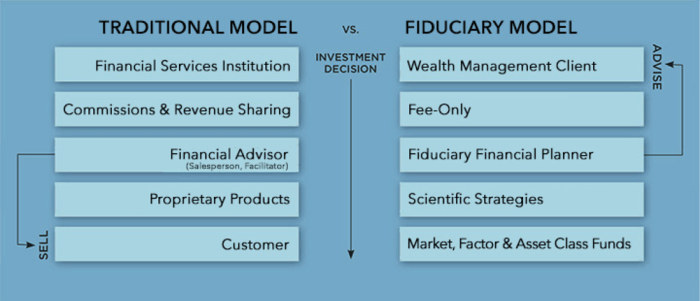

When it comes to financial planning, there are two main types of advisors you may encounter: fiduciary financial advisors and traditional financial advisors. Each plays a crucial role in helping individuals manage their finances, but they have distinct differences in their responsibilities and legal obligations.

Role of a Fiduciary Financial Advisor

A fiduciary financial advisor is legally obligated to act in the best interests of their clients at all times. This means they must prioritize their clients' financial well-being above all else and provide recommendations that are most beneficial to their clients' financial goals.

Responsibilities of a Traditional Financial Advisor

On the other hand, a traditional financial advisor is typically held to a suitability standard, which means they must recommend investments that are suitable for their clients' financial situation, but not necessarily the best option available. Traditional advisors may also have conflicts of interest that could influence their recommendations.

Legal Obligations Comparison

- A fiduciary financial advisor has a legal obligation to act in the best interests of their clients, providing unbiased advice and recommendations.

- A traditional financial advisor is only required to recommend investments that are suitable for their clients' financial situation, which may not always be the most advantageous option.

Situational Examples

- A fiduciary financial advisor may be more suitable for individuals looking for personalized, unbiased advice tailored to their specific financial goals and needs.

- On the other hand, a traditional financial advisor may be suitable for individuals who are more focused on short-term gains and are comfortable with potentially limited investment options.

Qualifications and Standards

When it comes to the qualifications and standards for fiduciary financial advisors versus traditional advisors, there are distinct differences that shape the way these professionals operate and serve their clients.

Certifications and Qualifications for Fiduciary Financial Advisors

Fiduciary financial advisors are held to a higher standard of care, requiring them to act in the best interests of their clients at all times. To become a fiduciary advisor, individuals must typically hold certifications such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Chartered Financial Consultant (ChFC).

These certifications demonstrate a commitment to ethical standards, professionalism, and expertise in financial planning and investment management.

Regulatory Standards for Traditional Financial Advisors

Traditional financial advisors are generally held to a suitability standard, which means they must recommend investments that are suitable for their clients' financial needs and objectives, but not necessarily in their best interests. These advisors are often regulated by organizations like the Financial Industry Regulatory Authority (FINRA) and must hold licenses such as Series 7 or Series 66 to provide investment advice.

Differences in Qualifications

The qualifications of a fiduciary advisor differ significantly from those of a traditional advisor due to the higher standard of care and ethical obligations they must meet. Fiduciary advisors are required to undergo rigorous training, hold specific certifications, and adhere to strict ethical guidelines to ensure they prioritize their clients' interests above all else.

On the other hand, traditional advisors may have fewer certification requirements and operate under a suitability standard that allows for more flexibility in their recommendations.

Client Relationships

In the realm of financial advisory services, establishing strong client relationships is crucial for ensuring successful outcomes and long-term satisfaction. Let's delve into the distinct approaches taken by fiduciary financial advisors and traditional advisors in managing client interactions.

Client-Advisor Relationship in Fiduciary Financial Planning

Fiduciary financial advisors prioritize their clients' best interests above all else, adhering to a strict code of ethics and legal obligations. This commitment to acting in the client's best interest forms the foundation of the relationship. Fiduciaries work diligently to understand their clients' financial goals, risk tolerance, and unique circumstances to tailor personalized strategies that align with their objectives.

By fostering open communication and transparency, fiduciary advisors aim to build trust and provide unbiased advice that serves the client's financial well-being.

Relationship Building in Traditional Advisor Practices

On the other hand, traditional advisors may operate under different standards, such as suitability requirements, which allow for recommendations that are suitable but not necessarily in the client's best interest. While traditional advisors also aim to create strong relationships with clients, their approach may involve a more sales-oriented focus or product-driven recommendations.

These advisors often prioritize revenue generation and may not always disclose potential conflicts of interest to clients upfront.

Importance of Trust and Transparency

Both fiduciary financial advisors and traditional advisors recognize the critical role of trust and transparency in client-advisor interactions. Trust forms the cornerstone of a successful advisory relationship, fostering open communication, mutual respect, and a sense of reliability. By maintaining transparency in their practices, advisors can instill confidence in their clients and demonstrate integrity in their recommendations.

Ultimately, establishing trust and transparency is essential for cultivating long-lasting relationships built on shared financial goals and a commitment to achieving positive outcomes.

Compensation Structures

Fiduciary financial advisors and traditional advisors have different compensation structures that can impact the way they work with clients. Here, we will explore the common fee structures for fiduciary financial advisors and how traditional advisors are compensated, along with potential conflicts of interest.

Fee Structures for Fiduciary Financial Advisors

- Fiduciary financial advisors typically charge fees based on a percentage of assets under management (AUM). This fee structure aligns their interests with those of their clients, as they are motivated to grow the client's investments.

- Some fiduciary advisors may also charge hourly rates or flat fees for specific services, providing transparency in how they are compensated.

Compensation for Traditional Advisors and Conflicts of Interest

- Traditional advisors often earn commissions from selling financial products, such as mutual funds or insurance policies. This can lead to conflicts of interest, as they may prioritize recommending products that benefit them financially, rather than what is best for the client.

- Additionally, traditional advisors may receive bonuses or incentives from the products they sell, further influencing their recommendations and potentially compromising the client's best interests.

Transparency of Fees

- Fiduciary financial advisors are required to disclose all fees upfront, providing transparency to clients about how they are being charged for services. This transparency helps build trust and ensures that clients understand the cost of working with the advisor.

- On the other hand, traditional advisors may not always be transparent about the fees they earn through commissions and incentives, making it difficult for clients to fully grasp the financial impact of their recommendations.

Last Recap

In conclusion, the discussion surrounding Fiduciary Financial Advisor vs Traditional Advisor has revealed the importance of trust, transparency, and legal obligations in the realm of financial planning. As you navigate the world of financial advisors, remember to consider these key differences to make informed decisions about your financial future.

FAQ Corner

What certifications are required to become a fiduciary financial advisor?

Typically, a fiduciary financial advisor needs to hold certifications such as CFP (Certified Financial Planner) or ChFC (Chartered Financial Consultant).

How are traditional financial advisors compensated?

Traditional advisors often receive commissions from selling financial products, which can sometimes lead to conflicts of interest.

What is the primary difference in client-advisor relationships between fiduciary and traditional advisors?

Fiduciary advisors are bound by law to act in their clients' best interests, while traditional advisors may have conflicts due to commission-based compensation.