Embarking on the journey of Mahindra Finance Share Analysis for Global Investors, this opening paragraph aims to intrigue and inform the readers with a comprehensive yet engaging overview.

The following paragraph will delve into the specifics and details of the topic at hand.

Mahindra Finance Overview

Mahindra Finance, a subsidiary of the Indian conglomerate Mahindra Group, was established in 1991 and has since become one of the leading non-banking financial companies in India. The company is known for providing a wide range of financial products and services to rural and semi-urban customers, with a focus on agriculture, vehicle financing, and other related sectors.

Core Business Areas

- Vehicle Financing: Mahindra Finance offers loans for the purchase of vehicles, including two-wheelers, cars, and commercial vehicles.

- Agriculture Financing: The company provides financial assistance to farmers for agricultural activities such as crop cultivation, equipment purchase, and more.

- Micro, Small, and Medium Enterprises (MSME) Financing: Mahindra Finance supports small businesses with loans and other financial products to help them grow and expand.

Geographic Presence

Mahindra Finance operates through a network of branches and offices across India, serving customers in both rural and urban areas. The company has a strong presence in states with significant agricultural and rural populations, such as Maharashtra, Gujarat, Rajasthan, and more.

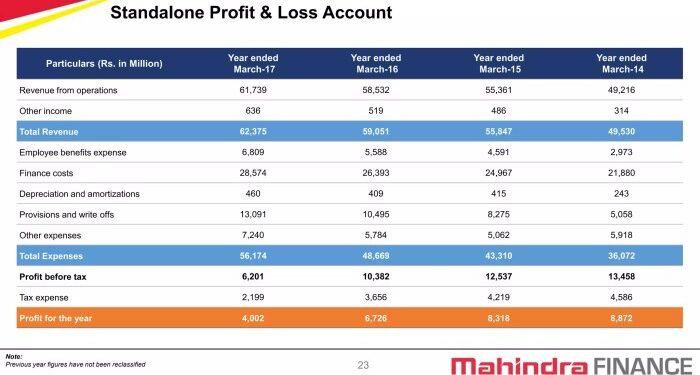

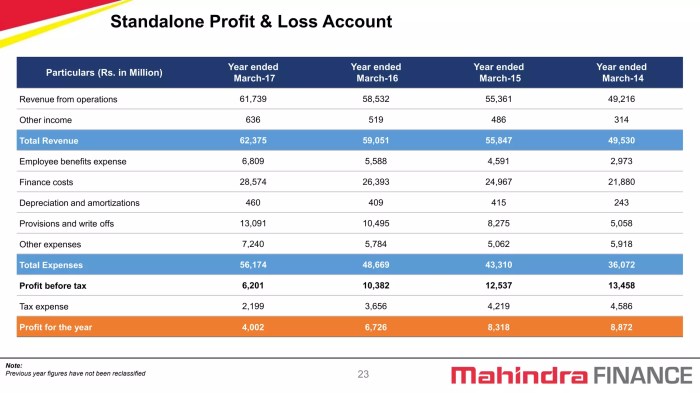

Key Financial Indicators

| Revenue | INR 15,678 crores |

| Net Profit | INR 1,234 crores |

| Assets Under Management | INR 87,543 crores |

Factors Influencing Mahindra Finance Share Price

When analyzing the factors that influence Mahindra Finance share price, it is important to consider a combination of macroeconomic, industry-specific, regulatory, and market sentiment influences.

Macroeconomic Factors Impacting Mahindra Finance Shares

- The overall economic environment, including factors like GDP growth, inflation rates, and interest rates, can significantly impact Mahindra Finance share prices.

- Global economic conditions and geopolitical events can also affect investor sentiment towards the company and its stock performance.

- Currency exchange rates and their fluctuations can have a direct impact on Mahindra Finance's financial performance and share price.

Industry-Specific Factors Affecting Mahindra Finance Shares

- Changes in the financial services industry, competition levels, and technological advancements can influence Mahindra Finance's market position and share price.

- Regulatory changes specific to the financial sector can impact Mahindra Finance's operations and profitability, thus affecting its stock performance.

- The company's own financial health, growth prospects, and strategic decisions can also play a significant role in determining its share price.

Regulatory Influences on Mahindra Finance Share Prices

- Government regulations related to lending practices, interest rates, and compliance requirements can directly impact Mahindra Finance's business operations and profitability, affecting its share price.

- Changes in tax policies and regulatory frameworks for the financial sector can create uncertainties for investors, influencing Mahindra Finance's stock performance.

Market Sentiment and its Impact on Mahindra Finance Shares

- Investor perception, market trends, and analyst recommendations can drive short-term fluctuations in Mahindra Finance share prices.

- Sentiments surrounding the company's performance, news, and events can create volatility in its stock value, reflecting market sentiment towards Mahindra Finance.

Mahindra Finance Competitive Landscape

Mahindra Finance operates in a competitive landscape with several key players vying for market share in the financial services sector. Let's take a closer look at how Mahindra Finance compares to its competitors and the strategies it employs to stay ahead.

Comparison with Key Competitors

Mahindra Finance faces competition from companies like Bajaj Finance, HDFC, and Muthoot Finance in the financial services sector. While Bajaj Finance is known for its consumer lending offerings, HDFC is a well-established name in housing finance, and Muthoot Finance specializes in gold loans.

Mahindra Finance, on the other hand, focuses on providing financial services to the rural and semi-urban markets, catering to the needs of customers in these underserved areas

Market Positioning

Mahindra Finance has positioned itself as a leading player in rural and semi-urban financing, leveraging its strong presence in these markets to serve the unique needs of customers. By focusing on agriculture, tractors, and rural infrastructure financing, Mahindra Finance has carved out a niche for itself in the market, differentiating itself from competitors who may have a more urban-centric approach.

Unique Selling Points

One of the key unique selling points of Mahindra Finance is its deep understanding of rural and semi-urban markets, allowing the company to tailor its products and services to meet the specific requirements of customers in these areas. Additionally, Mahindra Finance benefits from the strong brand reputation of the Mahindra Group, which instills trust and credibility among customers.

Growth Strategies

Mahindra Finance has employed several growth strategies to stay competitive in the market, including expanding its branch network to reach more customers, introducing innovative products and services, and leveraging technology to enhance customer experience. By focusing on digital initiatives and process efficiencies, Mahindra Finance aims to streamline operations and improve customer satisfaction, staying ahead of competitors in the rapidly evolving financial services landscape.

Investment Potential and Risks

Investing in Mahindra Finance shares can offer significant potential for global investors looking to diversify their portfolio and tap into the growing financial services sector in India. With a strong track record of growth and a solid presence in rural and semi-urban markets, Mahindra Finance presents an attractive investment opportunity.

Investment Potential in Mahindra Finance Shares

- Mahindra Finance has shown consistent growth in its loan portfolio, driven by increasing demand for financing in rural areas.

- The company's focus on digital transformation and expanding its reach through technology can enhance its operational efficiency and customer acquisition.

- Strong brand reputation and the backing of the Mahindra Group provide a sense of stability and credibility to investors.

Key Risks Associated with Investing in Mahindra Finance

- Exposure to the rural economy makes Mahindra Finance vulnerable to external factors such as monsoons, crop failures, and changes in government policies.

- Fluctuations in interest rates can impact the company's profitability and loan repayment rates.

- Increased competition from banks and other financial institutions can put pressure on margins and market share.

Mitigating Risks for Global Investors

- Diversifying the investment portfolio to spread risk across different sectors and geographies can help mitigate the specific risks associated with Mahindra Finance.

- Regular monitoring of market conditions, regulatory changes, and macroeconomic indicators can provide early warning signals to adjust investment strategies accordingly.

- Engaging with local experts and financial advisors in India can offer valuable insights into the market dynamics and help make informed investment decisions.

Future Opportunities and Challenges for Mahindra Finance

- Opportunities: Expansion into new geographies, introduction of innovative financial products, and leveraging technology for enhanced customer experience.

- Challenges: Regulatory changes, increasing competition, and managing non-performing assets in a challenging economic environment.

Conclusive Thoughts

Concluding our discussion on Mahindra Finance Share Analysis for Global Investors, this final paragraph encapsulates the key points and leaves readers with food for thought.

FAQ Guide

What are the key financial indicators of Mahindra Finance?

The key financial indicators of Mahindra Finance include revenue growth, profit margins, asset quality, and capital adequacy ratios.

How can global investors mitigate risks when investing in Mahindra Finance?

Global investors can mitigate risks when investing in Mahindra Finance by diversifying their portfolio, conducting thorough research, and staying updated on market trends.

What are the unique selling points of Mahindra Finance compared to its competitors?

Mahindra Finance distinguishes itself from competitors through its strong market presence in rural and semi-urban areas, innovative financial products, and customer-centric approach.